south carolina inheritance tax 2019

Large estates that exceed a lifetime exemption of 1206 million are subject to the federal estate tax. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

Cazare Poiana Brasov Pensiune Poiana Brasov La Pensiunea De 3 Stele Casa Vlasin Brașov Case

You should also keep in mind that some of your property wont technically be a part of your estate.

. It is one of the 38 states that does not have either inheritance or estate tax. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets and any prior taxable gift amounts combined add up to more than 12060000 for 2022. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Unique to South Carolina is a 44 exclusion or subtraction from the capital gains. See where your state shows up on the board. Still individuals who are gifted more than 15000 in one calendar year are subject to the federal gift tax.

Washington States 20 percent rate is the highest estate. Has the highest exemption level at 568 million. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation.

8 00 9 TAX on excess withdrawals from Catastrophe Savings Accounts. October 16 2019. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Delaware collects a gross receipts tax from businesses. South Carolina does not assess an inheritance tax nor does it impose a gift tax.

South Carolina does not levy an estate or inheritance tax. The effective state and local tax rate for south carolina residents in 2019 was 89 percent the 11th lowest percentage among the 50 states according to a new ranking published by the tax foundation. Federal exemption for deaths on or after January 1 2023.

So if you and your brother are in a car accident and he dies a few hours after you do his estate would not receive any of your property. This is your TOTAL SOUTH CAROLINA TAX10 00 30752190 Page 2 of 3 Your SSN _____ 2019. Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits.

Like estate taxes and inheritance taxes South Carolina also does not have a gift tax. No estate tax or inheritance tax. South Carolina does not levy an estate or inheritance tax.

However the federal government still collects these taxes and you must pay them if you are liable. South carolina does not levy an estate or inheritance tax. In addition to the federal estate tax of 40 percent some states levy an additional estate or inheritance tax.

You pay inheritance tax as part of your income taxes in the form of inheritance-based. To inherit under South Carolinas intestate succession statutes a person must outlive you by 120 hours. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. South Carolina does not levy an estate or inheritance tax. There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be subject to it.

South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds estate soon after the loved one has passed. 7 TAX on Lump Sum Distribution attach SC4972. 9 00 10Add line 6 through line 9 and enter the total here.

Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state. Individuals should also know about the federal estate tax. No inheritance tax in South Carolina.

Twelve states and the District of Columbia impose estate taxes and six impose inheritance taxes. Large estates may be subject to the federal estate tax and you may need to pay inheritance if you inherit property from someone who lived in another state. Not every state imposes the Inheritance Tax and South Carolina is one of many that does not.

7 00 8 TAX on Active Trade or Business Income attach I-335. Maryland is the only state to impose both. But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state.

Federal exemption for deaths on or after January 1 2023. In case you inherit a property from a resident of another state you will have to pay that states local inheritance tax. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005.

If an estate is worth 15 million 36 million is taxed at 40 percent. Up to 25 cash back Survivorship period. While South Carolina itself does not levy inheritance laws there may be cases when the states resident would still owe a related tax due.

However that does not mean that there are no taxes or fees that are imposed on an estate in South Carolina. If an estate is valued over a certain amount 1158 million in 2020 the estate is. There are no inheritance or estate taxes in South Carolina.

A Guide To South Carolina Inheritance Laws

10 House Hunting Lessons You Can Learn From The Tv Shows House Hunting Best Car Insurance Car Insurance

Warnermedias Restructuring Plans Hit Dc Entertainment Tesla Said Tuesday That Its Board Had Approved A Five For One Split In Its So Tesla Tax Holiday Layoff

Home Buying Process Infographic Home Buying Process Home Buying Buying First Home

152 Westfield Dr Pawleys Island Sc 29585 Mls 1914502 Zillow Pawleys Island Pawleys Island Sc Island

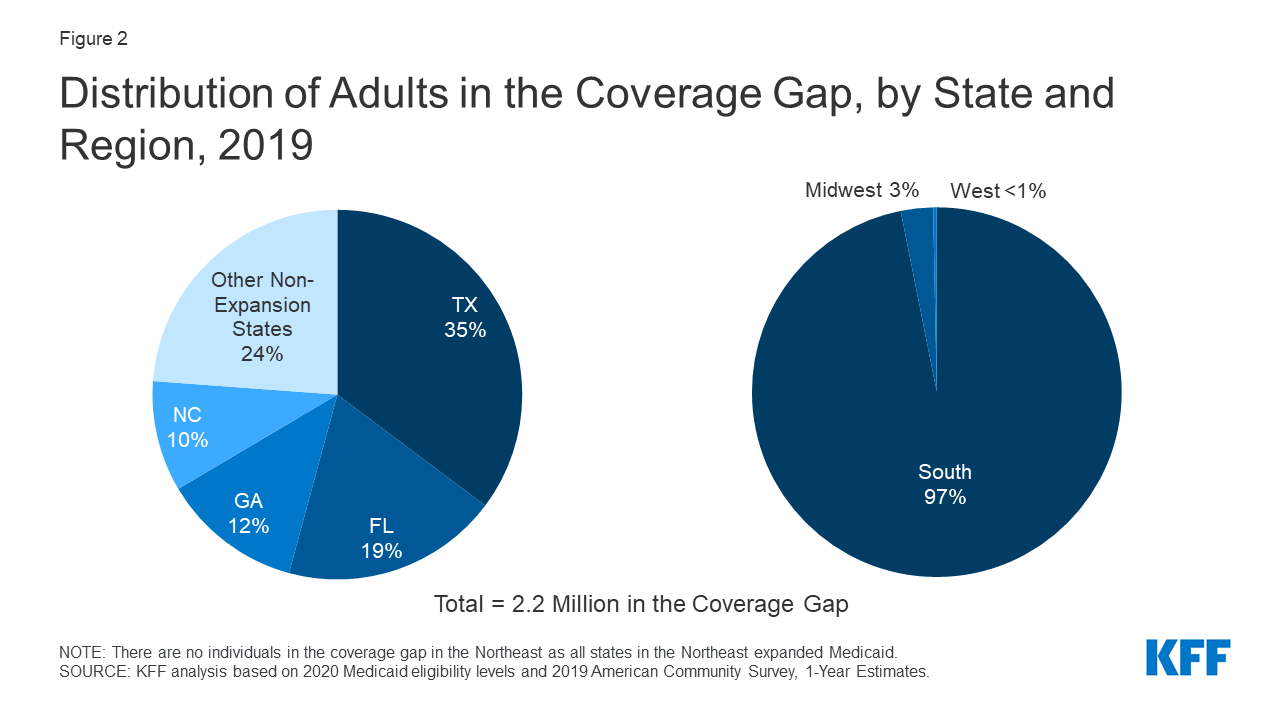

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Pin On Maya Smart Author Early Literacy Advocate

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

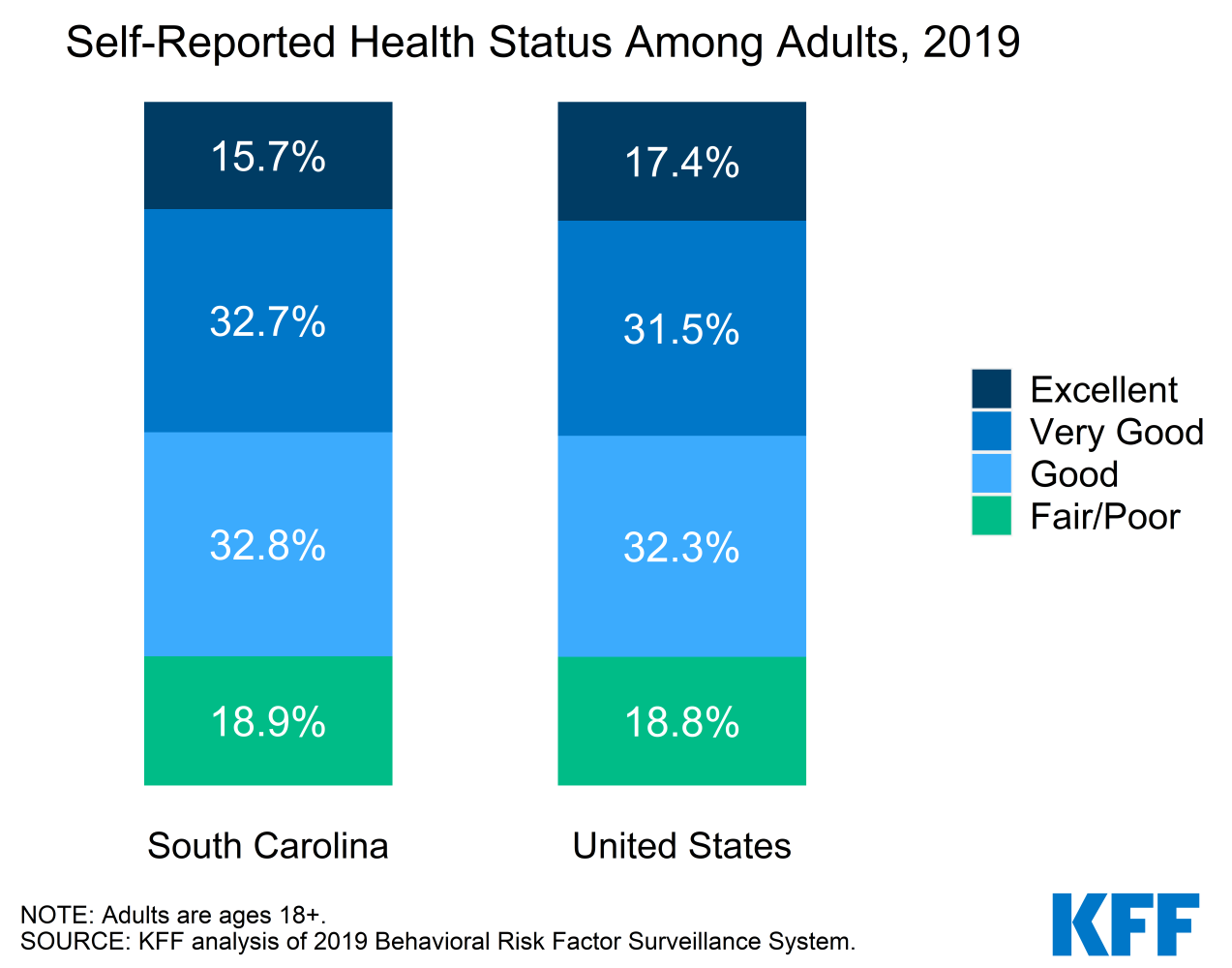

Election 2020 State Health Care Snapshots South Carolina Kff

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

A Guide To South Carolina Inheritance Laws

More Than 1 In 8 Oklahoma Children Live In A Home Where The Head Of The Household Doesn T Have A High S Counting For Kids Education Issues Health Care Coverage

A Guide To South Carolina Inheritance Laws

Dothan Beige Slim Fit Check Pants Bespoke Daily Slim Fit Dress Shirts Mens Plaid Pants Stylish Mens Outfits

New Trending Gif On Giphy Carolina Panthers Nfl Mike Mccarthy